do you pay taxes on a leased car in ct

If you choose to switch methods in later years specific rules for depreciation will apply. Personal property taxes are taxes you pay.

Please type in top search bar.

. Contact the subreddit moderators with questions comments or. A37OO re car wash services excluding coin-operated car washes effective July 1 2015 and applicable to sales occurring on or after that date and to sales of services that are billed to customers for a period that includes said July 1 2015 date. Taxes may be paid online.

Call 860 647-3016 for details. 12-450 re suspension of liquor permit for failure to pay taxes or to perform acts or duties imposed under statutes. Dropped car at dealer 0913.

117 Responses to My Car Has Been In The Shop For A Month. Depending on where you lived the premiums could be 25 of the price of the car. October 19th 2010 at 1149 am.

Learn about leasing offers including term mileage down payment and monthly prices. For vans with a model year 20 years old or older you do not need a title. Monday - Friday 900 am.

Do I Have A Lemon 1 Anthony Brown says. To replace your Connecticut auto registration complete the Request for a Duplicate Motor Vehicle Registration Form B-341 and mail it along with payment for the 20 car registration replacement fee. Manufacturers fabricators and processors are the consumers of and must pay tax on all services to real property provided at their industrial plants machine shops warehouses or any other commercial or industrial site unless the services provided qualify as services rendered in the construction of new real.

They gave me rental 0914- have not heard a word since 2009 kia sedona purchased 122009 new 2 LemonLaw says. We are all old enough to remember the 80s when all of the Japanese brand cars carried premiums. MEMBERS OF ARMED FORCES - One car belonging to or leased by an active duty serviceperson may be completely tax exempt each tax year.

You must make the choice by the return due date including extensions of the year the car is placed in service. You can also deduct the business portion of personal property taxes you pay on your vehicle. During periods of high volume we appreciate your patience.

Vans from other states or countries can have different requirements. If youre self-employed you can also deduct your car loan interest thats related to your business use of the car. However you cant deduct the amount you pay for parking at your place of employment.

Learn more about proof of ownership documents. For CT residents the application is available in Miscellaneous Forms and Documents and is labelled One-Vehicle Exemption. When lease contained provision that rental should be reduced one-half in case city wherein premises leased were located should go no license passage of Volstead act operated to reduce rental one-half.

15-5 added exemption for creation development hosting or. If you want to use the standard mileage rate for a personally owned car you must use that method the first year the car is used for business. If you CT car registration is lost or stolen you must obtain a duplicate vehicle registration from the Connecticut Department of Motor Vehicles.

August 15th 2011 at 426 pm. For Non-Residents use the form labelled Military. Salesmen dont set the price the management does so dont blame the salesman.

If payment is made by Personal check a release will be issued after ten 10 business days. If you have delinquent motor vehicle taxes or are planning to register a vehicle with the Department of Motor Vehicles and require a release from the Tax Collector you must pay with Cash Credit Card Money Order or Certified Bank Check. Taxes may be mailed to.

April 30 1987 at 17. Bill of Sale PDF. Please do not mail in cash payments.

While we do not accept donations or payment of any kind we strongly suggest that you support Legal Aid and other public service legal organizations either by donating directly to the Legal Services Corporation or finding your state or local Legal Aid office and donating to them. If you wish to have a receipt returned to you please include a self-addressed envelope with your payment. Find the best Lexus lease deals on Edmunds.

Prepare to pay the registration fees. Lease a Lexus using current special offers deals and more. Taxes may be put in a secure DROP BOX at the left of the front doors of Town Hall which will be checked several times a day.

Instead you need the registration from the last owner. Town of East Windsor Tax Office11 Rye Street Broad Brook CT 06016. The salesman wants to sell you a car because he has kids to feed and a mortgage to pay.

Box 2216 Waterbury CT 06722-2216.

What S The Car Sales Tax In Each State Find The Best Car Price

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Pre Negotiated Deal 2021 Bmw X3 Suv For 470 Month 0 Down Ttl Leasehackr

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

What Are The Tax Benefits Of Leasing A Car For Business Debt Com

Connecticut S Sales Tax On Cars

What Is A Lease Buyout Loan And How Do I Get One Forbes Advisor

Car Accidents With Leased Cars Adam Kutner Attorneys

You Can Sell Your Leased Car For A Profit Here S How Much Yaa

Is Leasing A Car A Losing Game Csmonitor Com

Illinois Car Sales Tax Countryside Autobarn Volkswagen

2022 Bmw X4 Lease Deals 0 Down Specials Ny Nj Pa Ct

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

Connecticut S Sales Tax On Cars

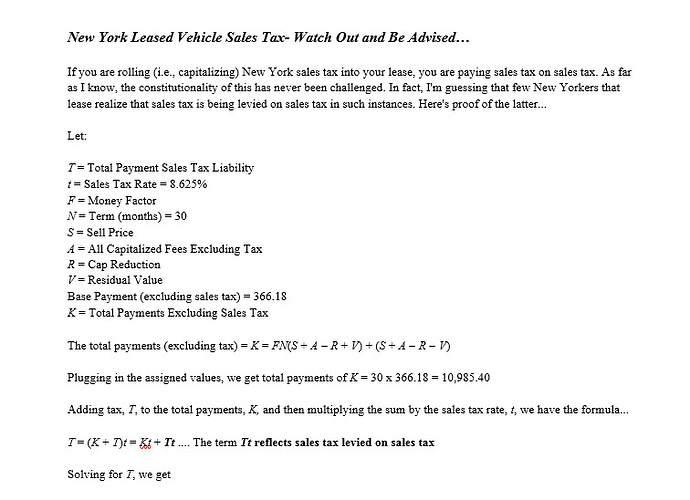

Sales Tax In Ny Off Ramp Forum Leasehackr

5 Main Benefits Of Leasing A Car Wilde Toyota

Which U S States Charge Property Taxes For Cars Mansion Global